rongha_2000

04-30 04:03 PM

They are bullsxxting themselves and everyone else. I am amazed..!! These committee members dont have a clue of what they are hearing about. Mixing GCs with H1-B. This issue is always a killer and more inportantly not even related to issue at hand..!!

I am losing hopes.. I might find solace in Alberta, I hope.

I don't understand how removing the country limit may have resorce implications, as how I understand is, instead of adjucation an EB-2(2008) from Mali you'll be adjucating an EB-2(2004) from India, what difference it is for them ???

I am losing hopes.. I might find solace in Alberta, I hope.

I don't understand how removing the country limit may have resorce implications, as how I understand is, instead of adjucation an EB-2(2008) from Mali you'll be adjucating an EB-2(2004) from India, what difference it is for them ???

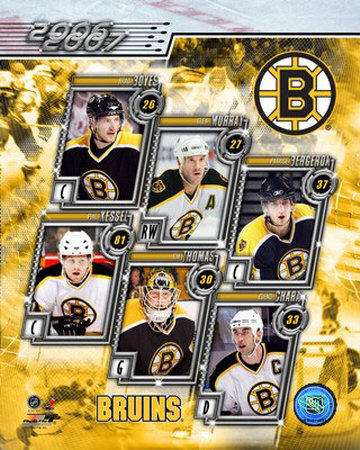

wallpaper Boston Bruins 2011 Eastern

bpratap

05-18 01:33 PM

Does any one face this ?

Bank asking 3yr VISA from the date of closing ?

trying to understand, if this Bank only is insisting for it.

Bank asking 3yr VISA from the date of closing ?

trying to understand, if this Bank only is insisting for it.

laknar

09-11 07:27 PM

Cannot join the rally but contributed 100$. Go IV.

Google Order #805244100043575

Google Order #805244100043575

2011 Boston Bruins captain Zdeno Chara hoists the Stanley Cup upon the team#39;s

franklin

07-23 06:44 PM

I think you are unnecessarily suspecting her posting. Retrogression kicked in Oct 2005 bulletin. So it is possible for her to apply in Feb 2005. I know for sure some people got their GC with similar priority dates. I think this whole immigration crap is turning everyone into cynical.

Original poster has corrected the dates, however, as you can see, certain categories were retrogressed long before Oct 05

http://travel.state.gov/visa/frvi/bulletin/bulletin_2007.html

Original poster has corrected the dates, however, as you can see, certain categories were retrogressed long before Oct 05

http://travel.state.gov/visa/frvi/bulletin/bulletin_2007.html

more...

rashbhat

08-12 10:05 AM

Just thought let me update my case here.

I filed my 485 on July 2nd @ NSC and my checks got cleared yesterday (8/11/07). So as per murthy's coment I tried looking @ back of the checks to get my LIN #'s and I was able to trace it in the USCIS web site and it shows "Application received and the Receipt notice mailed".

So I feel like they are aggressively working on the applications which are filed on July 2nd and hopefully everyone will get their Receipt notice by end of this week.

Hope this will help many people and give a good hopes.

Thanks

I filed my 485 on July 2nd @ NSC and my checks got cleared yesterday (8/11/07). So as per murthy's coment I tried looking @ back of the checks to get my LIN #'s and I was able to trace it in the USCIS web site and it shows "Application received and the Receipt notice mailed".

So I feel like they are aggressively working on the applications which are filed on July 2nd and hopefully everyone will get their Receipt notice by end of this week.

Hope this will help many people and give a good hopes.

Thanks

gc_maine2

04-04 10:27 AM

:confused::confused:

I am excerpting Internal Revenue Code Section 1361 below:

Internal Revenue Code

� 1361 S corporation defined.

(a) S corporation defined.

(1) In general.

For purposes of this title, the term �S corporation� means, with respect to any taxable year, a small business corporation for which an election under section 1362(a) is in effect for such year.

(2) C corporation.

For purposes of this title, the term �C corporation� means, with respect to any taxable year, a corporation which is not an S corporation for such year.

(b) Small business corporation.

(1) In general.

For purposes of this subchapter, the term �small business corporation� means a domestic corporation which is not an ineligible corporation and which does not�

(A) have more than 100 shareholders,

(B) have as a shareholder a person (other than an estate, a trust described in subsection (c)(2) , or an organization described in subsection (c)(6) ) who is not an individual,

(C) have a nonresident alien as a shareholder, and

(D) have more than 1 class of stock.

(2) Ineligible corporation defined.

For purposes of paragraph (1) , the term �ineligible corporation� means any corporation which is�

(A) a financial institution which uses the reserve method of accounting for bad debts described in section 585 ,

(B) an insurance company subject to tax under subchapter L,

(C) a corporation to which an election under section 936 applies, or

(D) a DISC or former DISC.

There is no mention here that the "resident" must be a permanent resident.

Here is an excerpt of the Federal Regulation that defines who is a "resident alien" for taxation purposes:

Reg �1.871-2. Determining residence of alien individuals.

Caution: The Treasury has not yet amended Reg � 1.871-2 to reflect changes made by P.L. 108-357

(a) General. The term �nonresident alien individual� means an individual whose residence is not within the United States, and who is not a citizen of the United States. The term includes a nonresident alien fiduciary. For such purpose the term �fiduciary� shall have the meaning assigned to it by section 7701(a)(6) and the regulations in Part 301 of this chapter (Regulations on Procedure and Administration). For presumption as to an alien's nonresidence, see paragraph (b) of �1.871-4.

(b) Residence defined. An alien actually present in the United States who is not a mere transient or sojourner is a resident of the United States for purposes of the income tax. Whether he is a transient is determined by his intentions with regard to the length and nature of his stay. A mere floating intention, indefinite as to time, to return to another country is not sufficient to constitute him a transient. If he lives in the United States and has no definite intention as to his stay, he is a resident. One who comes to the United States for a definite purpose which in its nature may be promptly accomplished is a transient; but, if his purpose is of such a nature that an extended stay may be necessary for its accomplishment, and to that end the alien make his home temporarily in the United States, he becomes a resident, though it may be his intention at all times to return to his domicile abroad when the purpose for which he came has been consummated or abandoned. An alien whose stay in the United States is limited to a definite period by the immigration laws is not a resident of the United States within the meaning of this section, in the absence of exceptional circumstances.

Here is the relevant Federal Regulation on Proof of Residence for determining status for tax purposes:

Reg �1.871-4. Proof of residence of aliens.

(a) Rules of evidence. The following rules of evidence shall govern in determining whether or not an alien within the United States has acquired residence therein for purposes of the income tax.

(b) Nonresidence presumed. An alien, by reason of his alienage, is presumed to be a nonresident alien.

(c) Presumption rebutted.

(1) Departing alien. In the case of an alien who presents himself for determination of tax liability before departure from the United States, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien, at least six months before the date he so presents himself, has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien, at least six months before the date he so presents himself, has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(2) Other aliens. In the case of other aliens, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(d) Certificate. If, in the application of paragraphs (c)(1)(iii) or (2)(iii) of this section, the internal revenue officer or employee who examines the alien is in doubt as to the facts, such officer or employee may, to assist him in determining the facts, require a certificate or certificates setting forth the facts relied upon by the alien seeking to overcome the presumption. Each such certificate, which shall contain, or be verified by, a written declaration that it is made under the penalties of perjury, shall be executed by some credible person or persons, other than the alien and members of his family, who have known the alien at least six months before the date of execution of the certificate or certificates.

(c) Application and effective dates. Unless the context indicates otherwise, ��1.871-2 through 1.871-5 apply to determine the residence of aliens for taxable years beginning before January 1, 1985. To determine the residence of aliens for taxable years beginning after December 31, 1984, see section 7701(b) and ��301.7701(b)-1 through 301.7701(b)-9 of this chapter. However, for purposes of determining whether an individual is a qualified individual under section 911(d)(1)(A), the rules of ��1.871-2 and 1.871-5 shall continue to apply for taxable years beginning after December 31, 1984. For purposes of determining whether an individual is a resident of the United States for estate and gift tax purposes, see �20.0-1(b)(1) and (2) and � 25.2501-1(b) of this chapter, respectively.

In summary, I submit to you that if you work in the US for more than 6 months out of a given year, you are a resident alien, and therefore are eligible to set up an S-Corp.

Since I am still learning about this, any input/feedback/logical arguments with relevant proof/citations would be appreciated!

Very good info, thanks for the posting. BUt its still not clear whether the spouse who is on EAD and does not work at all or for that matter 6 months in a given year, will she/he be eligible for setting up a S -corp??

Thanks

sree

I am excerpting Internal Revenue Code Section 1361 below:

Internal Revenue Code

� 1361 S corporation defined.

(a) S corporation defined.

(1) In general.

For purposes of this title, the term �S corporation� means, with respect to any taxable year, a small business corporation for which an election under section 1362(a) is in effect for such year.

(2) C corporation.

For purposes of this title, the term �C corporation� means, with respect to any taxable year, a corporation which is not an S corporation for such year.

(b) Small business corporation.

(1) In general.

For purposes of this subchapter, the term �small business corporation� means a domestic corporation which is not an ineligible corporation and which does not�

(A) have more than 100 shareholders,

(B) have as a shareholder a person (other than an estate, a trust described in subsection (c)(2) , or an organization described in subsection (c)(6) ) who is not an individual,

(C) have a nonresident alien as a shareholder, and

(D) have more than 1 class of stock.

(2) Ineligible corporation defined.

For purposes of paragraph (1) , the term �ineligible corporation� means any corporation which is�

(A) a financial institution which uses the reserve method of accounting for bad debts described in section 585 ,

(B) an insurance company subject to tax under subchapter L,

(C) a corporation to which an election under section 936 applies, or

(D) a DISC or former DISC.

There is no mention here that the "resident" must be a permanent resident.

Here is an excerpt of the Federal Regulation that defines who is a "resident alien" for taxation purposes:

Reg �1.871-2. Determining residence of alien individuals.

Caution: The Treasury has not yet amended Reg � 1.871-2 to reflect changes made by P.L. 108-357

(a) General. The term �nonresident alien individual� means an individual whose residence is not within the United States, and who is not a citizen of the United States. The term includes a nonresident alien fiduciary. For such purpose the term �fiduciary� shall have the meaning assigned to it by section 7701(a)(6) and the regulations in Part 301 of this chapter (Regulations on Procedure and Administration). For presumption as to an alien's nonresidence, see paragraph (b) of �1.871-4.

(b) Residence defined. An alien actually present in the United States who is not a mere transient or sojourner is a resident of the United States for purposes of the income tax. Whether he is a transient is determined by his intentions with regard to the length and nature of his stay. A mere floating intention, indefinite as to time, to return to another country is not sufficient to constitute him a transient. If he lives in the United States and has no definite intention as to his stay, he is a resident. One who comes to the United States for a definite purpose which in its nature may be promptly accomplished is a transient; but, if his purpose is of such a nature that an extended stay may be necessary for its accomplishment, and to that end the alien make his home temporarily in the United States, he becomes a resident, though it may be his intention at all times to return to his domicile abroad when the purpose for which he came has been consummated or abandoned. An alien whose stay in the United States is limited to a definite period by the immigration laws is not a resident of the United States within the meaning of this section, in the absence of exceptional circumstances.

Here is the relevant Federal Regulation on Proof of Residence for determining status for tax purposes:

Reg �1.871-4. Proof of residence of aliens.

(a) Rules of evidence. The following rules of evidence shall govern in determining whether or not an alien within the United States has acquired residence therein for purposes of the income tax.

(b) Nonresidence presumed. An alien, by reason of his alienage, is presumed to be a nonresident alien.

(c) Presumption rebutted.

(1) Departing alien. In the case of an alien who presents himself for determination of tax liability before departure from the United States, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien, at least six months before the date he so presents himself, has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien, at least six months before the date he so presents himself, has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(2) Other aliens. In the case of other aliens, the presumption as to the alien's nonresidence may be overcome by proof�

(i) That the alien has filed a declaration of his intention to become a citizen of the United States under the naturalization laws; or

(ii) That the alien has filed Form 1078 or its equivalent; or

(iii) Of acts and statements of the alien showing a definite intention to acquire residence in the United States or showing that his stay in the United States has been of such an extended nature as to constitute him a resident.

(d) Certificate. If, in the application of paragraphs (c)(1)(iii) or (2)(iii) of this section, the internal revenue officer or employee who examines the alien is in doubt as to the facts, such officer or employee may, to assist him in determining the facts, require a certificate or certificates setting forth the facts relied upon by the alien seeking to overcome the presumption. Each such certificate, which shall contain, or be verified by, a written declaration that it is made under the penalties of perjury, shall be executed by some credible person or persons, other than the alien and members of his family, who have known the alien at least six months before the date of execution of the certificate or certificates.

(c) Application and effective dates. Unless the context indicates otherwise, ��1.871-2 through 1.871-5 apply to determine the residence of aliens for taxable years beginning before January 1, 1985. To determine the residence of aliens for taxable years beginning after December 31, 1984, see section 7701(b) and ��301.7701(b)-1 through 301.7701(b)-9 of this chapter. However, for purposes of determining whether an individual is a qualified individual under section 911(d)(1)(A), the rules of ��1.871-2 and 1.871-5 shall continue to apply for taxable years beginning after December 31, 1984. For purposes of determining whether an individual is a resident of the United States for estate and gift tax purposes, see �20.0-1(b)(1) and (2) and � 25.2501-1(b) of this chapter, respectively.

In summary, I submit to you that if you work in the US for more than 6 months out of a given year, you are a resident alien, and therefore are eligible to set up an S-Corp.

Since I am still learning about this, any input/feedback/logical arguments with relevant proof/citations would be appreciated!

Very good info, thanks for the posting. BUt its still not clear whether the spouse who is on EAD and does not work at all or for that matter 6 months in a given year, will she/he be eligible for setting up a S -corp??

Thanks

sree

more...

HV000

07-21 07:46 PM

It's A Shame That Most Of Preminant Democrats Have Voted No!!!

2010 NHL Men#39;s Boston Bruins 2011

swede

04-03 08:58 AM

RIR EB3, filed in PA. Now in Philladelphia BEC

PD Dec 2002

45 days letter received May 2005

My 6 year H1B expire in Aug 2006

:(

PD Dec 2002

45 days letter received May 2005

My 6 year H1B expire in Aug 2006

:(

more...

newuser

09-11 04:00 PM

I second that.

hair Andrew Ference Boston Bruins

arnab221

06-20 10:50 AM

My employer is a big wall street investment bank, and they have filed my PERM on May 14th.

The trend for PERM certification at Atlanta, as per my employer is between 90-120 days. Because they handled so many PERM cases at Atlanta, they know this trend.

Nothing muck we can do here. Just pray and hope for the best.

PRAYING WILL NOT HELP : God and the US helps those who help themselves . :D

The trend for PERM certification at Atlanta, as per my employer is between 90-120 days. Because they handled so many PERM cases at Atlanta, they know this trend.

Nothing muck we can do here. Just pray and hope for the best.

PRAYING WILL NOT HELP : God and the US helps those who help themselves . :D

more...

amitjoey

07-18 04:58 PM

Contributed $100 for now through Google checkout. Will be giving more eventually. :)

Appreciate it.

Appreciate it.

hot Boston Bruins #26 Blake

diptam

08-13 02:24 PM

Thanks - I'll write a mail to the HR head to release 7001 on my request and will mention that they don't have to take responsibility. Enough is enough - i got another 2 yr H extension in July 08 so i should be good,anyway.

I'll keep you guys posted when i receive 7001 from HR by mail and i'll send it to Ombudsman office (along with that cover letter) immediately.

You should be fine. Everything we are doing is legal. We are not doing anything illegal by requesting Ombudsman's office to look into this processing delays.

I'll keep you guys posted when i receive 7001 from HR by mail and i'll send it to Ombudsman office (along with that cover letter) immediately.

You should be fine. Everything we are doing is legal. We are not doing anything illegal by requesting Ombudsman's office to look into this processing delays.

more...

house Boston Bruins 2011 Stanley

gcisadawg

02-09 12:47 AM

Did I even say this? What are you saying? Go see a shrink :D

Read first what I said.

OOPS! mea culpa! It is a case of bad negation! It should have read as "How come it is not 'stupid' when a girl spends husband's money to support her parents?"

Read first what I said.

OOPS! mea culpa! It is a case of bad negation! It should have read as "How come it is not 'stupid' when a girl spends husband's money to support her parents?"

tattoo 2011 Cheap NHL Jerseys Boston

vallabhu

01-05 02:38 PM

Looks like it is random, it may also depend on the service where it is applied from, Mine is from vermont, Nov 2003 received the 45 letter, I have another one from Atlanta June 2004 did not receive the 45 day letter.

more...

pictures Game 6 is tonight in Boston.

Totoro

05-07 12:56 PM

Love your attitude. Basically it is "I got the stimulus so tough luck if you didn't."

Second thing. Nobody has posted in this thread for days. However, by making a comment, all you did was bump it to the top of the discussion. If you don't like this thread, why are you bumping it?

Second thing. Nobody has posted in this thread for days. However, by making a comment, all you did was bump it to the top of the discussion. If you don't like this thread, why are you bumping it?

dresses Final Patch Boston Bruins

priti8888

07-23 03:30 PM

my PD were current in 2005.

One thing is confirmed:

When PD are "current" they approve cases based on RD.

My guess is in Oct or Nov 2007 PD would retrogress to jan/may-2004 for EB3 India. So hang in there guys!!..They will approve a lot of cases with older RD by Sept 30. They are hell bent on not wasting any visa numbers henceforth.

One thing is confirmed:

When PD are "current" they approve cases based on RD.

My guess is in Oct or Nov 2007 PD would retrogress to jan/may-2004 for EB3 India. So hang in there guys!!..They will approve a lot of cases with older RD by Sept 30. They are hell bent on not wasting any visa numbers henceforth.

more...

makeup Boston Bruins 2011 NHL Stanley

sunny1000

06-02 03:07 PM

Also wanted to point out that the "dual intent" provision of the H1-B will be removed by this new CIR bill which will make matters worse for the people with I-485 pending as those applications can be rejected based on that.:(

More bad news for the legals

More bad news for the legals

girlfriend Boston Bruins 2011 Stanley Cup

Libra

09-11 07:56 PM

anandsumit, anzerraja, laknar thank you for your contributions.

hairstyles Tyler Seguin Boston Bruins

immm

07-18 03:27 PM

I am confused about receipt date?

Is receipt date the date when they do data entry into the system or is it the date when they receive the package even though they may do data entry a month later?

My application was sent on June, 14th and delivered on June 15th (I have the FedEx tracking info and signature page confirming 6/15).

The case status online based on receipt number (obtained by calling them a few times until I got lucky) says:

"On July 11, 2007, we received this I485 APPLICATION TO REGISTER PERMANENT RESIDENCE OR TO ADJUST STATUS, and mailed you a notice describing how we will process your case."

Not sure if the online status is referring to the receipt date or the notice date when it says "On July 11, 2007, we received" when, in fact, they received it on June 15th!!

.

Is receipt date the date when they do data entry into the system or is it the date when they receive the package even though they may do data entry a month later?

My application was sent on June, 14th and delivered on June 15th (I have the FedEx tracking info and signature page confirming 6/15).

The case status online based on receipt number (obtained by calling them a few times until I got lucky) says:

"On July 11, 2007, we received this I485 APPLICATION TO REGISTER PERMANENT RESIDENCE OR TO ADJUST STATUS, and mailed you a notice describing how we will process your case."

Not sure if the online status is referring to the receipt date or the notice date when it says "On July 11, 2007, we received" when, in fact, they received it on June 15th!!

.

ak_2006

05-30 11:02 AM

Contribute generously....

Thanks in advance

Thanks in advance

sunofeast_gc

07-23 06:27 PM

This is aboslutly not possible; he/she is trying to fool every one. Before retrogression, the last date to file a 485 for a EB3-Indian with PD 08/2004 was 12/31/2004. From Jan 2005 till July 2007 EB3 Inida was retrogressed for his PD. So he/she could not apply 485 in Feb 2005. The other optins could be he/she may be in EB2 catagory or a Schulde A nurse.

I was in similar time frame; So I know the date well....

Same thing came in my mind too....

it must be EB2 or a Schulde A nurse

anyway it good to know that someone got GC...

I was in similar time frame; So I know the date well....

Same thing came in my mind too....

it must be EB2 or a Schulde A nurse

anyway it good to know that someone got GC...

No comments:

Post a Comment